OTTAWA – Prime Minister Justin Trudeau wants the Canadian business community to know that this pandemic and the governmental response to it will in no way alter the Liberal government’s policy of not doing a goddamn thing about corporate tax avoidance.

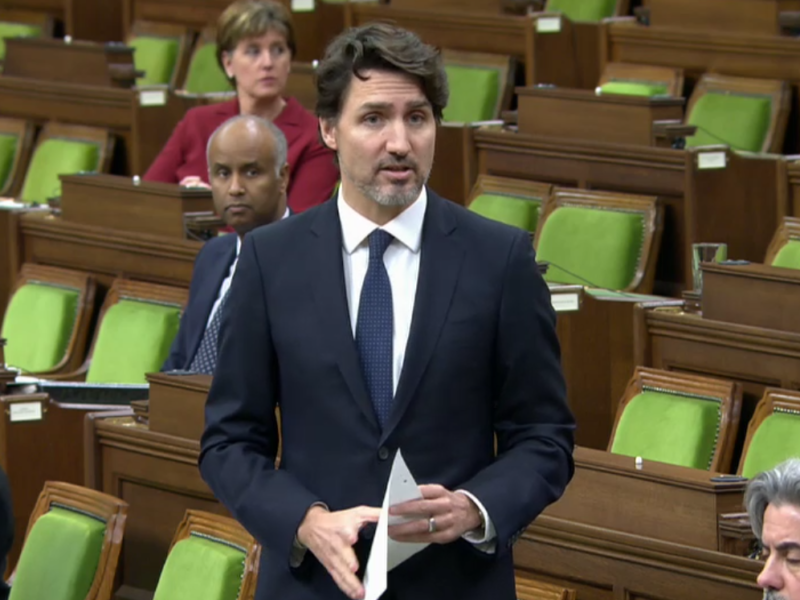

“For five years this government has taken a hands-off approach to wealthy individuals and corporations using every loophole in the book to avoid paying taxes, and now is not the time to alter what has been one of our most dependable and successful policies,” Trudeau said this week during Question Period.

“Our goal is for everything to go back to normal when this pandemic ends, and that includes the corporate use of tax havens to keep $10 billion out of the government’s coffers every year.”

Several European countries have refused to give bailout funds to corporations that avoid paying domestic taxes by parking their money in offshore tax havens, and while members of the Bloc Québécois and NDP have asked Trudeau to do the same, he’s made it clear that just because a corporation has done everything in its power to avoid paying taxes to the Canadian government is no reason for the Canadian government not to use the taxes it dutifully collected from other Canadians to bailout these deadbeat corporate citizens.

“Not to mention the fact that it would be highly hypocritical of us to punish corporations for using legal tax loopholes when, as we demonstrated through our response to the Panama Papers, we don’t even punish corporations for using illegal tax loopholes,” Trudeau explained.

At press time, the Canadian government had agreed to requests from several companies to deliver their bailout funds in the form of a small velvet bag of uncut diamonds left in a bus station locker in Luxembourg.